|

Money has been a part of human civilization for thousands of years. It started as a simple barter system where people exchanged goods and services for other goods and services. But as societies grew and became more complex, so did the concept of money. From shells and beads to coins and paper currency, money has taken on many forms throughout history.

However, one thing that has remained constant throughout history is the exploitation of women for economic gain. Women have been treated as commodities since the beginning of time. In many ancient societies, women were sold into marriage or used as property to settle debts. In some cultures, women were even sacrificed to appease the gods or used as currency in trade negotiations. Even today, women are still being utilized for economic benefit. The gender pay gap is a prime example of this. Women are often paid less than men for doing the same job, which means they have less economic power and are more likely to live in poverty. Trafficking is another example of how women are exploited for economic gain. It is estimated that millions of women and girls are forced into the trade every year, often against their will. They are treated as commodities to be bought and sold, and their bodies are used to generate profit for traffickers. In conclusion, while money has evolved over time, the exploitation of women for economic gain has remained a constant throughout history. It is important to recognize and address these issues in order to create a more just and equitable society for all. Women should be valued for their contributions to society, not treated as commodities to be bought and sold. So when frustration and injustice rises up in you after you watch the Barbie movie, or Sound of Freedom, or you decide to woke up and see the discrepancy between genders you might recognize it has been an inequity since the BEGINNING! Women have been the MOST VALUABLE asset for trade. However, it has been abused and became an insult against the souls of each individual. It is now an abused and manipulated power of currency and it has to stop. An Urgent Call to Action It's natural to feel frustrated and upset about gender inequality, whether it's after watching a movie like Barbie or Sound of Freedom, or simply waking up to the harsh reality. The truth is, gender inequity has been an ongoing issue since the very beginning of human history. Women have always been deemed as a valuable asset for trade, but this has been taken advantage of, becoming an insult to the very soul of each individual. It's time to end this cycle of abuse and manipulation of power.

0 Comments

Medical bills are a leading cause of debt and bankruptcy in the United States. It is so unfortunate that we pay thousands of dollars per month for Medical Insurance, but then are faced with pills of Medical Bills after we seek medical treatments. Similar to other problems in the United States, I do not know the answer to this one, but I do have a solution for you to consider. Medical Bills are not bills that you can pre plan for, or save for in advance, unless the medical decision is most often elective. This content is going to be for the bills that you were not able to prepare for.

Here are my 4 recommendations as to how to best deal with Medical Bills you did not have time to financially plan for:

You: Hello,I am calling because I received a medical bill that I am having trouble paying. Can you help me understand what options I have. [Representative explains the options] You: Thank you for explaining my options. Is there a settlement amount you would take today to clear this bill? [Representative may offer payment plan, financial assistance number or settlement discount] You: I appreciate that, but I was wondering If theres any further room for a reduction to my bill. This expenses is really weighing on me. I am willing to pay, but the full amount via a payment plan, and/or that small of a discount is not going to make a difference on my ability to pay. If you are not able to offer a larger discount may I please speak to your Manager? [Representative says this is the best they can do] You: Okay thank you, at this time I am going to continue to postpone making a payment on this bill at the full amount that is listed. I simply can not afford this amount. In the meantime, can I please have your supervisors contact Information to further this discussion and an Itemized bill for the services I am paying for? Although this may not always work, it is worth a try. In addition, it is important to note that I recommend before you begin your negotiations and settlement discussion, make sure you know your target amount. How much are you willing to pay and how much can you afford to agree to. You need to be able to follow through and not be greedy. In the event they are not willing to compromise. Thank them for their time and try again another day in hopes that the representative is more flexible the next time you call to discuss the settlement agreement. If they threaten to send your bill or inform you that your bill will be sent to a collections company. You need to understand that this is a consequence of you not being able to pay the bill in full. It is an annoying reality, but it is the reality of unpaid bills. However, if the collections company does get your bill, they will most likely harass you, which is annoying, but you may be able to negotiate and come to a settlement agreement with them that is more affordable for you. None of this is easy. It is all annoying! It is very time consuming and if you are not fit to have these discussions I do recommend putting them off a little while until you have the emotional stamina to get into the ring and fight for a discount. Or, look to a friend or family member who can do the negotiations on your behalf. If you go this route, be sure to have strict boundaries in place to not allow them to agree to a payment you are not able to uphold. According to Equifax, "As of July 1, 2022, paid medical collection debt will no longer appear on credit reports. And the time period before unpaid medical collection debt appears on your credit reports increases from 6 months to 1 year. Be sure to be your first advocate. If you can afford to pay the bill in full, just do it. However if you can not these are recommendations to allow yourself a little bit of breathing room. I do not want to see you putting these bills off forever and hoping they will go away. They wont! Be wise, be kind and be a responsible adult when approaching your medical debts. On October 15th, 2020, Spencer hooked up his Rubicon Jeep to our RV trailer and planned to drop off the trailer at a campsite on his way to Mayo for an appointment. We were really looking forward to a weekend camping with our close friends. We believed this would be the last appointment for Spencer at Mayo. We were so confident that he was going to get great news and then we would spend the weekend celebrating. We believed the episodes he was feeling over the last few months were minor and he would just need to stay on blood thinners to prevent any further damage.

Later that day, I loaded the kids up and embraced the tension of the unknown as I drove the kids to the campsite. We arrived at the campsite, and it felt like any other arrival. Friends greeting one another. Laughing and hugging as we each set up our individual sites. Shortly after our arrival, Spencer arrived from his appointment. My stomach dropped. I became numb in that moment. I could not see straight I was confused as to where I was. It was like something beyond me came over me. Spencer approached me and I knew in that moment the news was not what we had hoped for. He looked me in the eyes and said, “Doctors confirmed it is Moya Moya disease. They are planning to consult my other neurologists and will be calling me with next steps.” I froze. My body flared up and I recall thinking, I have been here before. I know this fear. I know this trauma. I cannot do this all over again. Spencer saw it in my eyes as I began to panic. The tears began to fall, and I said, “You need brain surgery? How soon? How long is recovery? Will you survive? I cannot do this again. I cannot do this again Spencer. I already had to go through this with Elliot. I cannot go through this with you!” The following days, weeks and months felt like a blur. I was doing everything I could to keep my head above water. I truly felt like I was drowning. Morning and night I was exhausted. I could only do the next best thing moment by moment. Payton was at home doing 3rd-grade distance learning, which was not working. Elliot was a 5-year-old boy who always needed all my attention. I was doing everything I could to hold my own emotions at bay and not show my immense amount of fear. I did not want to scare Payton and Elliot with the unmeasurable unknown of when they would go back to school and answering their inquiries of if their Daddy would be okay. The unknown was hell. Each day I sat in the tension of choosing the best next decision. Happiness was far away during these days. I was surviving and working so hard to find joy in it all. We were together I would tell myself. He is with us. He is going to get fixed, and everything will be okay. December 4th, 2020, he went in for an 8-hour surgery where the doctors did a surgical bypass of his blocked artery. His recovery was a full 8 weeks. Each day he would have greater and greater stamina until he was able to be upstairs with me and the kids for a full day. As of today, 7 months post-surgery, Spencer is still experiencing minor effects from his surgery, but overall, we made it! How? I cannot be sure. It honestly was so intense and so incredibly hard, but we are out of the valley. From October until just recently I feel like I have been incredibly focused on Payton and Elliot’s emotional health, Spencer’s recovery and my own personal & mental health. It has been really challenging during it all to focus on my business as a Mortgage Advisor. Trauma is so intense, and I am the first one to admit I cannot do it all. I did the best I could throughout the last 7 months, but the area I had to let go of was communicating my passion and love for my job. It was scary saying I will take this time to be what my family needed. It was scary to trust that in the unknown and to pause, hoping that the business success and momentum I was experiencing would return. The unknown is still hard. I am in the unknown right now. It is a new unknown. It is not the unknown of when will the kids go back to school, or will Daddy be okay, but it is now my own unknown. It is the unknown of will my business return to what it was before trauma hit. I am still in the tension of the unknown. I know with confidence that it has always been one of the key expectations I communicate with any new borrowers I work with. I express I am a mom and a Wife first. I will never place my career in front of the well-being of my family. I make it a point to ask my borrowers if they are okay with this expectation. I am realizing on this side of trauma that I truly lived out this expectation. However, here I am, communicating that we made it out of the valley, and we are now on the other side. I am ready to move out of this tension of the unknown as a Mortgage Advisor. I am ready to see my business return to where it was, and even better yet, grow beyond where it was. To everyone who honored me during these last 7 months and put your trust in someone else for financial guidance, thank you. Please take this update as a reminder that I am back at full capacity, and I would love to be a resource for you and a referral to anyone you know who is looking to purchase a home or refinance their current mortgage. What are your goals for 2021? This question has been very difficult to answer. Do I go big and project to double what I did in 2020 because 2020 was a joke, or do I stick with what I did in 2020 because 2021 is still such an unknown?

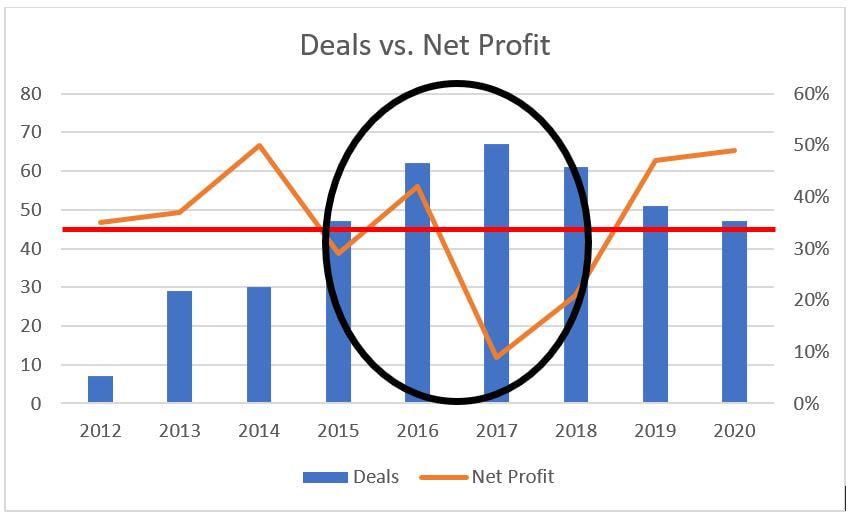

I still do not have an answer for where I will land for my 2021 goals, but what I do know is that, in my opinion, going bigger is not always the answer. In 2012, Spencer started his Real Estate business. In his first “year” (August-December) he did 7 deals. 2013-29 solo, 2014-30 solo, 2015-47 (+1 Agent), 2016-62 (+1 Agent), 2017-67 (+4 Agents). As you can tell, we just kept on growing… until 2018. He added team members and other agents to help him scale his presence. We hired an employee to handle more of the work that was not his strength. I scaled back on my work outside of the Real Estate business so I could be more hands on. We were 100% focused on growth. We were going to be a change agent in the Real Estate industry. Growth was all that was on our mind. We were taught that growth equaled success which equaled financial freedom and ultimately freedom as a family. However, what we were not taught was at what cost it would come. At the end of 2017 and into 2018, we made a very hard decision to pull back. We just could not sustain the growth and expansion we were experiencing. Spencer was burning from both ends of the candle, I was miserable and experiencing anxiety higher than I had ever experienced in my life. Our kids were melting down and having behavior issues we could not explain, and our marriage was on the verge of falling apart. I can not explain to you the stress Spencer was carrying. We had for years believed in and casted the vision for exactly what was happening. Success was the product of all our hard work. Statistically, Spencer was on fire. He was winning every award possible. He was a huge deal, but our home and our souls were dying, and we almost pushed it too far. I honestly think we called it quits just before an explosion occurred within our relationship. We were headed toward Divorce. We just could not hang. It was not because of anything between us. It was because of all the demands of life we could not keep up with. We knew we were at a fork in the road. We had to either choose success and accolades as we understood it or choose our family and risk what that could do to the business. In 2018, the deconstruction began; Spencer and 2 agents closed 61 deals. My career journey was parallel in nature to Spencer’s and very much contributed to our near rock bottom. I was engulfed in my job. I loved it so much and could not believe I was given such an incredible role as a Financial Business Specialist for Financial Advisors within Ameriprise Financial. Unfortunately, however, I was drowning. I had not taken time off after Elliot’s traumatic entrance into the world. I was living in an everyday fight or flight pressure cooker. After Elliot’s heart surgery, I was so excited to get back to work that I did not take time to process all that happened to him, or me. After 2 years of living this way, I called it quits. In October of 2018, I walked away from what I believed was my dream job.. So here we were, I no longer had a job and Spencer no longer had his team in place to sustain the growth and expansion we were for so long taught to chase. During the subsequent years, 2019 and 2020 and beyond, our household as a unit and individually sought out what it would look like to operate as a flourishing family unit. More on how we accomplished this later, but we focused on prioritizing us first. We no longer looked at accomplishment as more accolades and more money. We found out that accomplishment for us meant a healthy home. One that was sustainable, predictable, content, joyful, balanced, and ultimately one that was abundantly whole and healthy from the inside out. In 2019, Spencer as the solo agent with 1 licensed support staff, closed the year with 51 deals, and I began a new career as a Mortgage Advisor closing 7 loans and in my first 10 months. This year, during a global pandemic, Spencer finished with 47 deals and I closed out the year with 30 loans. However, as we think about what is to come for 2021 for our family and our businesses, we both continue to remind ourselves that our accomplishments are not found in the volume of deals we close, but instead in the health of our hearts and our home. The most beautiful testimony in all of this is not only did we accomplish success in our home emotionally by adjusting, but we also have accomplished our financial goals, our time freedom goals, our travel goals, and our relationship goals. The books all say that the only way to accomplish these things is through financial/business growth. However, we are here to let you know that is not our reality. In 2019 and 2020, our business productivity recovered to the range we expected out of the business. Our net profit has been the key measure of our business health and our household sustainability. Please see the graph below for statistical evidence of our reality. Based on this evidence, I can assure you the problem was not mismanagement of earnings. It was our inability to maintain the growth while still maintaining our overall soul health. Something had to give to bring better balance overall. Our goal has always been to accomplish both, not one or the other. If at any point our net profit was below 35% (the red line on the graph) I have learned it is a direct impact of more than just market conditions or mismanagement of resources. What I want to leave you with is this, growth does not always equal success. Growth does not always equal profitability. Growth does not always equal a healthy heart and a healthy home. As you go into goal planning for 2021, be sure to assess not just your numerical goals from 2020, but take note of your overall physical, spiritual, mental and relational health. Growth and success are attributes we aim for in our family, but it is not more valuable than our holistic health as individuals and as a family. I hope you take your goal setting for 2021 and see it as an opportunity to look through the lens of what holistic health looks like for you and not just how you can reach the next level of growth and success. We all have things that we do in our lives that make our day to day easier, more enjoyable and hopefully more affordable. Here are a few of the things we do in our home that make our lives easier, more enjoyable and have resulted in a more affordable way of life.

HSA ACCOUNT An HSA account is a Health Savings Account. The purpose of this checking/savings account is for us to deposit funds monthly into this account to spend only on qualified medical expenses. The IRS has a list of what those are here https://www.irs.gov/publications/p969. Each year the types of things that qualify as well as how much you are able to deposit into the account may change. It’s always important to speak with your Tax Professional each year if you plan to use an HSA. Why do we choose an HSA? The reason we use an HSA is because it has three benefits for us. The first one is the money can go into the account tax free. The second benefit is that those dollars we deposit into the account are from our business account. We are able to expense the HSA deposit as a business deduction which ends up being a write off for us at the time of filing our taxes. The third benefit is the dollars, if not spent, can grow tax free in the account. If we need to pay for a qualified medical expense, we can use these dollars and they can be withdrawn tax free. This works for us because of how we have our household and business setup. To choose an HSA is not as simple as saying, well that sounds wise, I am now going to do an HSA account. All the ducks need to align. What I mean by that is our business is structured in a way that personal medical expenses can be reimbursed to us as owners. Second, our health insurance is a high deductible HSA insurance plan and third we know we have the funds to be able to contribute into the account to reach the max amount to get the greatest tax benefit. Speak with your Tax Professional and your Financial Advisor be certain this would be a good idea for you. CREDIT CARD REWARDS: CHRISTMAS As a household, we have three credits cards. All three are through chase.com. We utilize our credit cards as if they are debit cards. 1 for Spencer's business, 1 for my business and 1 for our household. It is essential to have three separate bank accounts and cards for each individual entity, so we do not co-mingle expenses. This is essential to have for accurate accounting (more on that in a future post). Why do we choose Chase credit cards? The reason we use Chase is because they give us cash back. Throughout the year, we allow each card to earn rewards. Then in November, I log into our account and funnel all the reward points to our personal card and cash them out. Once the funds deposit into our checking account then I begin our Christmas shopping for the year. It is essential I wait till the funds are in our account and not just to a credit to our card. I want to be able to see the deposit as income on our budget so I can designate a line item as an expense in our zero-based budget. We use www.everydollar.com for budgeting and LOVE IT! Unless I budget additional dollars for Christmas presents, our cash reward dollars are our cap to what we will spend. Each year thus far it has been just what we have wanted to spend. How great is that, our spending throughout the year pays for our Christmas and due to paying the cards off each month we NEVER accrue interest on the cards, so the cash back is 100% free money. SUBSCRIPTIONS: Subscription Services-we have access to Hulu, Disney +. Dish TV, Amazon Prime, YouTube Music, Netflix, Audible, Blue Apron, Melaleuca, Amazon Fire Freetime, Google Storage, Gopher Magazine, EveryDollar, Apple Music, Voxer Premium, Apple TV+, Moshi Premium, NHRA TV, Aptive Environmental, Dry Cleaning and Happy House Cleaners. Each of these subscriptions are either paid for by us, our business or a family member. We have decided among our family that we will share our logins where we are able. For example, my sister pays for Hulu and we pay for Disney+ and my mom pays for Dish TV. Due to our trust level, we feel comfortable sharing our logins with one another. This opens our viewing options greatly. ALL our subscriptions are for personal enjoyment and ease of life: Amazon Prime- As an introvert during a global pandemic I love this-yes please, ship everything to me so I do not need to leave my house! YouTube Music- Spencer loves the spontaneous worship he can get on YouTube Music. You can only have 1 user for this platform so when he is listening to music I cannot, so I have my own music platform I prefer which is Apple Music. I love being able to have access to full CD's at the time of their new release. Audible- My preferred way of reading is through Audiobooks. I paid for 1 month of the membership and each time I finish a book, I simply return it and my credit is reimbursed to me. Then I select a new book and enjoy. The only downfall of this method is I am not able to highlight or save content for future reference. Blue Apron- For two years we used HelloFresh meals and LOVED them, but then we needed to make some dietary adjustments to a Mediterranean based diet. HelloFresh unfortunately did not have this option, so we made the switch. Having a meal delivery service is perfect for our family. I can whip together an amazing breakfast, lunch and snack platter, but ask me to come up with a dinner plan and I freeze. Spencer on the other hand loves to cook but does not have the time to do the grocery shopping and meal planning. Blue Apron and HelloFresh have done the heavy lifting for us. I am able to grocery shop for the essentials, and Blue Apron delivers us the meal idea and ingredients perfect to size. Then Spencer cooks them. It has been a game changer for our family. It also eliminates food waste and follows Spencer's needed diet restrictions without us having to think about it. Melaleuca-Another benefit to not have to go to a store. Shopping for household cleaners and everyday soaps is not something that excites me. They are necessities of life, but truly are annoyances for me. 6+ years ago we signed up for Melaleuca to have a semi cleaner option for our household products. We ended up having a few friends decide they wanted the same for their homes. Now I spend around $70 a month on cleaners and I make a commission of around $70 a month. This was an easy way to improve our household products and not have to pay for them. Over the course of 6 years we have saved around $5000 by using this system. No, I do not sell the products or recruit people to join my MLM. We simply use them because we believe they are a better option then some mainstream products on the market. Amazon Fire Freetime Unlimited- We sometimes need a break as parents and that can look like allowing our kids to read books, play games and watch shows on their Amazon Fires. The reason we love our Amazon Fires for the kids is because we can set their profiles to only allow for them to have access to age appropriate content. All the games, books and shows are preloaded, so we do not have to be constantly asked to download something new. If the kids want to exchange a game, they know how to eliminate it from their home screen and choose a new one. The best part, in my opinion, is they do not have access to YouTube Kids. There is something with YouTube Kids that does not bring out the best in our kids. Anyone else with me? Google Storage- This is simply to have a place to backup all our digital content. It is linked to all our phones, and computers. I have had moments where I have accidently deleted something very important and I am so grateful we have this setup to be able to recover what was or could be lost. Gopher Magazine, Moshi Premium, Voxer Premium, EveryDollar Premium- These are all just great because they all allow us to utilize more features of the applications that make our lives easier. Gopher-Spencer gets more content and can interact with the content, Moshi-Payton loves the stories at bedtime to listen to, Voxer-well sometimes I need to recall a message! EveryDollar-I love that it links to our bank accounts. Aptive Environmental, Dry Cleaning & Happy House Cleaners-I do not have time to spray for bugs, iron Spencer's shirts or to deep clean our house. As a result, quarterly we have hired Aptive to treat our house for bugs. We pay to have Dry Cleaning done as needed and have house cleaners come every 3 weeks. It really is well worth the investment to keep the pests from getting into our house, having nicely pressed shirts for Spencer and a clean home. My time is better spent with my family or earning money doing what I love to do. It is not that I feel I cannot do these things, I just would rather not. Bottom line with all of these items listed above that we have implemented in our family is that they help us to be more present with one another. They help us stay in our own lanes of what we are good at. Our family believes that we have skills that brings out the best in us. To do those things with excellence we choose to do those things and not try to do everything else on our own. We have identified our best yes's and have said no to the rest. When we say no, that means we must delegate and hire if we want to keep to the cultures and standards of our family. Although these are not necessarily Hacks by the traditional definition, they are Hutton Hacks. The things that make our life more enjoyable, easier and more affordable. "I've learned that your passion for helping others with finances is strong and you excel at it!" This quote originated from my older brother after we closed on his refinance. If you have an older brother you might be able to relate with me when I say their approval means EVERYTHING! The age gap between my brother and I, 9 years, created a feeling for me that I was his annoying little sister who often got in the way. This was never his perspective, but instead mine, due to me not being able to engage in all the cool things he got to do growing up due to our age gap. Fast forward to March 9th, 2020 when my brother and I sat down to restructure his home loan. Of course, I was not overwhelmed by old feelings of annoyance, but I was overwhelmed with gratitude. Of course, I wanted to make sure that their refinance was the best financial decision for his family, but more importantly I wanted to be sure the experience was beyond excellent. Today, May 8th 2020 their refinance funded. I am beyond pleased with how well the transaction went. My brothers quote was, "sometimes timing is on your side and other times its a lot of strategy and a little bit of luck... we locked in an amazing rate for next to no points at just the right moment by being patient and anticipating the market. Amber and her team stepped up to the plate on this one and are right to be proud of their work." We had an amazing experience together as Brother and Sister in business. However, it was not something we easily walked into. It took preparation, honesty and selflessness to know if it was in both of our best interests. I need to be 100% honest with you. If you can not uphold the following key boundaries and expectations when entering into business with family and/or friends then I 100% DO NOT RECOMMEND YOU DO. This blog post is my recommendations on how to do it with excellence from a professional to a client perspective. I will only endorse you attempting this style of business if you as the professional are able to do ALL that I am going to outline. If you do not, there is a high likelihood that mixing business with family and/or friends could go really really bad. I will address being the consumer/client on the other side of the business at the end of the post. BOUNDARIES: WHEN & WHERE TO DISCUSS: If you are the professional who is offering the service that the family and/or friend has come to for your expertise you are in the drivers seat. It is critical that you uphold a HIGH level of confidentiality and it must be something that is deep within you not something you embody, just because they are a family member or close friend. When you are in a social setting, you DO NOT bring up the topic unless the customer/borrower/client brings up the topic. Even then, you let them drive the conversation and you stay quiet unless they bring you into the topic. This is their purchase. It is not about you the professional getting the attention or sharing your voice. If the client brings up the topic in a public setting, you ONLY engage if they welcome you into the conversation. Additionally, if you have items you need to discuss while you are together and it is urgent be sure to privately ask them if there is an opportunity that you and the individual can step away to discuss. If I receive an email from my team and I know it is urgent I will still take the same steps I would with a non-family or friend relationship. Forward the email and within the email outline the need to discuss when they are free. Yes, they might be at the same picnic as I am, but I want them to decide when they want to address the urgent need. PROFESSIONALISM: Yes these people are your friends and family, but that does not dismiss the need for you to treat them and the service in a professional manner. If you usually do a first meeting to outline the process of the service you are providing then be sure you uphold your normal routine. The reason they are coming to you is because they have seen how seamless you execute. If you decided to skip out of your normal process then they are not going to experience you in your fullness. Yes it might seem a bit awkward to put on your professional hat, but it is critical you keep to your normal process and procedure. You will naturally want to cut corners, but I beg you do not fall for the temptation. If you are going to walk into this space of doing business with family and friends, you must keep to your normal process. If you have boundaries with other clients like not texting after a certain time, you do this with these clients as well. If you have a text message thread for friendship or family discussions, it is critical you evaluate if starting a new thread for ONLY the business discussions is necessary and best for the relationship. SERVANTHOOD, WIN-WIN & SAME TEAM ATTITUDE: Keeping your heart posture in a position of, this is about serving my client and getting them the absolute best outcome MUST always be at the forefront of every single decision and conversation. I can tell you this is the element of doing business with family, friends and even strangers that is the MOST critical. A heart posture that says, this is about you and I am going to do everything in my control to maintain a healthy and honoring relationship with myself and with you. I am going to uphold the rules and regulations I am committed to due to my license, and I am going to honor your needs, wants and desires to the best of my ability. This can be an opportunity to see everyones true colors! I have heard of so many horror stories where the professional allowed the consumer to call the shots throughout the transaction. They decided they wanted to cut a corner which then put the professional in a tough spot to decide if they should cut the corner, or uphold their moral and ethical business code. I have also seen professionals get lazy and decide to not work as hard for a family member or friend due to the desire to 'just take a break' and this puts both parties in a hard spot. It is critical that you as the professional stay as true to who you are in all other transactions as you are within this style of transaction. Lastly, keeping a same team attitude is critical. Staying focused on the ultimate goal, which is to ensure that the consumer gets the outcome they desired from the beginning. It is your job, as the professional, to keep tabs on if that outcome is still possible as each step is taken in the transaction. If at any point that outcome is no longer possible honesty and respect MUST be upheld. This is not a chance to blame or get frustrated, but rather addressing what is happening, explaining why it is happening and communicating your opinion, as the professional, that the business process is no longer going to result in a win-win/same team outcome. No business transaction is worth burning a family or friend relationship over. It is possible to sense and be in tune to an unhealthy outcome before it is too late. IF YOU ARE THE FAMILY OR FRIEND: To choose if you should or should not do business with your family or friends is a really hard decision. For example: My brother in my earlier example could have easily gone to his current mortgage company and simply said, hey can you please refinance my mortgage? A Loan Originator would have taken his file and processed his request. It could have been awesome-we have no way of comparing, but he also would have been put in a tough spot. The thought he likely would have wrestled through was, "I know my sister does this same thing, what if she finds out I refinanced? How do I have this conversation that honors my boundaries, but also is honoring her and her profession? This is how she makes a living." To be honest, THIS IS SO HARD. I do not wish this conversation on anyone, however if we are all honest, we know this conversation and thought process is a very common one. Although it can be hard, it also can be done with excellence. If done with a high amount of honor, respect and zero selfishness it can go better than expected. This conversation above, is real- it was the conversation my brother and I had. It was not easy and we both had to put on our adult hats and hear one another fully. We both gave space to one another to make the best decision for ourselves and our families. We both signed up to love one another regardless of the final outcome. I can tell you, I have never felt more understood and known by my brother than after we concluded our conversation. My advice for any family members or friends wanting to do business with family and friends know that it is possible and can be done with excellence, however it must be taken with the proper preparation. Trusting the recommendations from the professional as they set the stage of the relationship is critical. This will help provide you with exceptional service with healthy boundaries. As I stated at the beginning, if the items above are not ones that you feel you are able to uphold in the business relationship then I do not recommend doing business with your family or friends. It just is not going to be worth it! In 2011 I graduated from College with a Bachelor’s Degree in Psychology with a minor in Biblical Studies....today, 2019- 8 years later, I am a Mortgage Lender/Loan Officer with a deep passion for Personal and Business Finance. How did I go from Psychology to Finance? The only dots I can connect between the two is my love for people, and my high success in Math, specifically Algebra and Stats. I was HORRIBLE at Geometry and Trigonometry. I never would have thought I would end up doing anything with numbers or even money as a student, because I was only good at 'basic math'. Honestly, I dreamed of being a Basketball Coach, or a Counselor and that is how I scored on my personality career assessments, so that means that’s what I am supposed to do, right? Not so much, although I would probably be good at both, I am unfortunately not doing either, sorry Mrs. Nelson (my career counselor in High School). Maybe she would have guessed Loan officer and finance nerd, or maybe she wouldn’t, either way I am happier than ever doing something I deeply love. What I love most about what I do is that I am working with complete freedom. I work because I want to, not because I have to! Getting to this place has taken time, discipline and consistency. Here is a look into how we approach our daily hustle to have work life balance focused around accomplishing our goal of ‘Working with Freedom’. TIME, DISCIPLINE & CONSISTENCY Our society is built around impatience. Time is not something we soak in when the thing we want is available. We do not say to a waiter, "just take your time. I will eat when you have time to prep my food". Or to the doctor, "I do not feel good, but go ahead and prescribe me a medication when you are free!" No, we are the complete opposite. We as a society try to do everything as fast as possible. On the regular, my kids demand 5 things at once of me, while my phone dings to alert me of a new text message about dinner plans at the same time my alarm is going off to switch the laundry and my Facebook notifies me the bicycle I have been watching has dropped its price. It is mind blowing how instantaneous our attention can be distracted. Surprise, Surprise, this instantaneous demand of you and your wants is not healthy! This is not the way we have accomplished our goal. We have reached a place at 30 and 36 years old that we are not scared about our cash reserves or our retirement. We have arrived here because we have been patient. We have stayed the course, not being swayed by the next idea or shinny object in front of our face. This does not mean we have not made adjustments or changes throughout our 8 years. What I mean is we have stayed focused on the goal, ‘Working with Freedom’. Only changing our plans if we knew it supported our work/life balance goal. We only have so much time in a day and we believe staying focused on the areas we are strongest in and those that give us our greatest Return on Investment (ROI) are the areas we invest our time. We know our ‘WHY’ for all our commitments. We have sorted through how our time is distributed and how it helps us reach our goal. Discipline and Time are closely related in our home. The only way for our family to manage our time is by being disciplined with our commitments. If we are running late from one meeting to the next, we are showing either a lack of discipline or a lack of time management. Our greatest asset to succeed in time management and discipline in our personal and professional life is sharing a joint calendar between Spencer and I. We use google calendar with colors that we both can edit and update. It has reduced so many time management errors. For us Discipline also looks like staying focused and appreciating the season we are in. For example, I graduated college and started working as a bookkeeper, then volunteered as a bookkeeper and controller for a church, from there I became a financial analyst and then a Financial Consultant for Financial Advisors and now am a Mortgage Lender. In all of these occupations, I was content! I LOVED what I was doing. I was serving others with the skills I had. It was not until I learned about additional knowledge, I could gain to better my craft that I began exploring career advancements. Each new occupation required discipline which allowed me to excel in my roles. Lastly, Consistency is the umbrella of all three traits that has led us to our goal. We have stayed true to who we are from 2011 to 2019. We have been people of integrity, honesty, dedication, loyalty, compassion, strong communication, generosity, coach-ability, patience and love. Without our consistency it would be incredibly hard to measure where we were going and if we had made any progress. Our goals have always stayed the same, no debt outside our mortgage, live on less than we make, save and invest, give abundantly to causes we are passionate about, travel and enjoy family and friends, laugh and be grateful always. These goals remaining consistent have ultimately led us to a lifestyle allowing us to Work with Freedom! What is my recommendation to all the College Graduates with Student Loans? This is a topic I have received inquires on so it is time that it deserves a post of its own. I am incredibly grateful that I left University without any college debt, but I know I am a rare occurrence. I also know it is not realistic to tell everyone they have the ability to do what I did, because my situation was unique. However, I think it is important for me to share how I did it, so that you might be motivated to look into creative options for yourself whether you are a High School Graduate, College Student, or Graduate.

When I was in High School I worked my Junior and Senior year at a golf course and a restaurant. My parents approached working with such a loving heart- they had me working because I had a motivation to earn my own money, but they were not forcing me to save for college or anything in specific. For the most part I paid for my own gas, but Mom and Dad were so sweet to help me out if I needed it. They wanted me to learn a healthy work ethic. This approach transferred into the way they funded our College. They told us kids they would pay for our first two years of public school tuition. After that, we were on our own. I can remember my first year of College hearing friends say, "I was given $5,000 more than I needed for my classes, lodging and books, so I have spending money for this semester." I remember feeling and thinking, "that is not fair, they get to just spend that money and someone just gave them it, they did nothing to earn it?" Wow, am I grateful my parents told me NO to asking for $5000 extra and that my parents did not qualify for Student Aid, which meant I was not able to get an extra $5,000. To be completely honest, I had no idea what Student Aid meant, or why they got the money. All I understood was that my friends were given more money to spend and I was not. THANK YOU MOM AND DAD! Fast forward, two years... now it is my turn to pay for College. I am now married and living off campus so I did not have the expense of lodging (except now we had a Mortgage to pay). I remember looking on every website to find discount books. I would be sure to sell my previous semester books, not to the campus bookstore, but on Amazon because I could make $15-20 more after shipping. This was worth it to me. It was equivalent to working a job for an hour and a half simply by changing the place I resold my books. Tuition was a lot larger and harder to pay. We learned at my University Spouses received 25% off Tuition the first year of their spouses employment and then 50% the next year. Thankfully, Spencer was already the Golf Coach at my University so he looked at becoming employed FT. He took the job and we started to SAVE! We paid for my two years of college by sacrificing. Spencer was not thinking he would be an Athletic Recruiter after he graduated college, but he knew the financial investment was worth it. He looks back now and sees how the Lord used his employment for way more than a Tuition discount. Oh I forgot to mention-Spencer is an incredible Golfer, so he paid for his College Tuition with a FULL RIDE to a Division 1 school in Texas! So what did we do with our remaining debt? And what should you do whether out of college or currently in college. Side point— the sooner you can do this the better because then you can either pay cash, or pay limited interest toward your tuition.

I know what you are thinking, I can't do that one, yeah that one won't work either, yeah that does not fit me and selling stuff-yeah that is not going to work either. My answer to your thoughts,"Yep then it will not work. If you are not driven or frustrated enough at your debt or potential debt, then you won't be motivated enough to make a change!" I can give you all the tools, but ultimately it is up to you! Get after it. Debt that is drowning you does not need to be part of your story, but putting on a life vest or learning to swim is a must to avoid drowning. Daughter, Mom, Wife and Friend, these are all titles that are easy to identify about me. If you were to see me at a coffee shop you could quickly recognize I am married because I have a ring, I am a mom because I have every protective cover offered to man on my iPhone and friend, daughter well those are given. What you may not know by quick glance is how passionate I am about finances, how I was raised or what I have gone through in life. With this being said, I believe it is a good idea to give space on this blog to who the I am personally and how it relates to finances.

When I think back to my childhood and my introduction to finances, I do not have a tangible memory of when I was first introduced to the topic. What I do remember is earning an allowance at a very young age. In the summer, I would wake up and before I had breakfast made for myself, I had already reviewed my chore list for the day. It would read something like, "Good morning, I am at the Shop...vacuum, dust and start cutting the grass Love, Mom. Day after day we would have chores we were responsible for written on a new piece of paper. My sister and I would negotiate who would do what. It did not matter when we did it, just as long as it was done before Mom got home. As I write this, I am missing these daily letters from my mom. Yes, they were written chores, but it was her being such an intentional mom. The chores helped her, but more importantly, they helped us. I believe my responsibility derived from these daily letters. As of today, Spencer and I have a 7.5 year old and a 3.5 year old. Our children do not have a written chore list, yet, but we are working with them by integrating kindness and thoughtfulness into their everyday which leads to financial reward for them. We did not Google the best approach to raising our children with financial wisdom, but instead we spent time thinking about how our children respond best for their ages. We created a simple chart labeled, 'Helping Hands' that hangs on our refrigerator. How the Helping Hands Chart works is anytime Spencer, myself or a sitter witnesses the kids loving, encouraging, serving and/or honoring one another or themselves we quickly say, "That just earned you a Helping Hand!" They quickly run and grab a marker and color in a square however they want on the chart. The chart is a joint chart because we believe it is important that our kids are one another greatest supporters, we do not need competition among one another. We want them bettering themselves today (more on this another time). To encourage this mindset, we have one Helping Hands Chart. When the kids have filled in more than 1 square they are allowed to withdrawal their earnings. Each square is worth a quarter. If there are two squares and Payton wants to make a withdrawal we will physically give each one their share of the Helping Hands. It is up to them if they decide to spend their portion. If they do not, they can either keep the quarters, or give them back to withdrawal at a later time. I believe this is our age appropriate equivalent to my childhood chores and allowance. It is a core culture in our family that our kids would have strong character. That they would see a need and be motivated to take initiative to care to the need. We want them to serve others and love themselves well. Of course they will not always be financially rewarded for these characteristics as they grow older, but our hope is the Helping Hand Chart creates the gap between good deeds and financial reward. As Payton and Elliot grow older we will likely need to adjust our approach, but for now we are seeing a lot of fruit from the Helping Hand Chart. |

|